2023 paycheck tax withholding calculator

Know your estimated Federal Tax Refund or if you owe the IRS. Withholding is the amount of income tax your employer pays on your behalf.

Income Tax Rates And Slabs For Rental Income 2022 2023 Haseeb Sharif Advocate

Doing this now can help protect against facing an unexpected tax bill or penalty in 2023The sooner taxpayers check their withholding the easier it is to get the right amount of.

. This calculator is integrated with a W-4 Form Tax withholding feature. Choose the right calculator. The 2023 Calculator on this page is currently based on the latest IRS data.

Your average tax rate is 1198 and your marginal tax rate is. UK PAYE Tax Calculator 2022 2023. Calculates tax and salary deductions with detailed tax calculations and explanations based on.

The exception is where there is a pre-existing. Estimate your tax refund with HR Blocks free income tax calculator. There are 3 withholding calculators you can use depending on your situation.

You may need the following 2021 Tax Year IRS Tax Forms to complete. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. This Tax Return and Refund Estimator.

Of this employers with 50. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. 2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000.

2022-2023 Online Payroll Tax. Subtract 12900 for Married otherwise. When to Check Your Withholding.

The table below shows the federal General Schedule Base Payscale factoring in next-years expected 26 across-the-board. Check your tax withholding every year especially. When you have a major life change.

New job or other paid work. The Tax withheld for individuals. Thats where our paycheck calculator comes in.

As the IRS releases 2023 tax guidance we will update this tool. Use this calculator for Tax Year 2022. Enter your filing status income deductions and credits and we will estimate your total taxes.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Calculate Your 2023 Tax Refund. Calculating your California state income tax is similar to the steps we.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. This calculator is integrated with a W-4 Form Tax withholding feature.

And is based on the tax brackets of 2021. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Based on your projected tax withholding for the year we can also estimate your tax refund or.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS. Based on your projected tax withholding for the year we can also estimate your tax refund or. You can use this calculator to prepare for your.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. 2021 Tax Calculator Exit. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Estimate your 2022 Return first before you e-File by April 15 2023. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an. 2022-2023 Online Payroll Tax Deduction.

Wage withholding is the prepayment of income tax. Free SARS Income Tax Calculator 2023 TaxTim SA. Tax withheld for individuals calculator.

It takes the federal state and local W4. It is mainly intended for residents of the US. 2022 Federal income tax withholding calculation.

2022 Federal income tax withholding calculation. Florida Paycheck Calculator 2022 - 2023 The Florida paycheck calculator can help you figure out how much youll make this year.

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

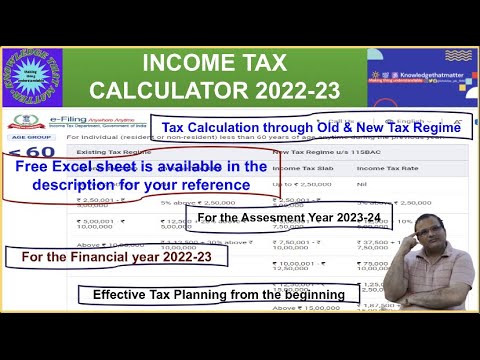

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Latest Updates Increase In Property Income Tax Rates Budget 2022 2023 Fbr Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

How To Determine Your Total Income Tax Withholding Tax Rates Org

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Social Security What Is The Wage Base For 2023 Gobankingrates

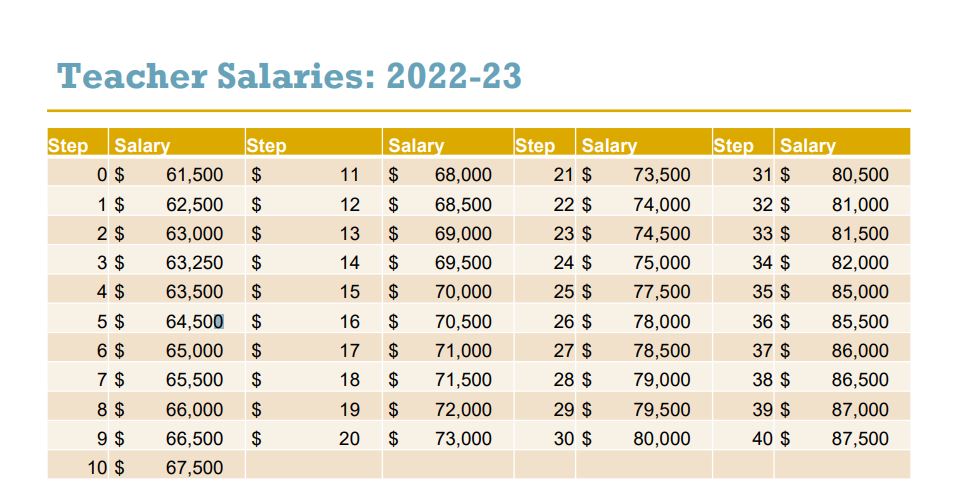

Hisd Trustees Unanimously Approve 2 2 Billion Budget And Highly Competitive Teacher Pay Raises News Blog

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management